Thinking about investing in luxury watches? It's about more than just buying an expensive timepiece. It's about acquiring a tangible asset that marries world-class craftsmanship with a very real potential to grow in value. I like to think of it as owning a piece of wearable art—a portable store of value that can bring a unique kind of diversification to a portfolio heavy on traditional stocks and bonds.

Why Invest in Luxury Watches Today

For a long time, a fine watch was a symbol of success or a way to mark a major life milestone. While that's still true, today they've also become a serious alternative asset class. It’s a fascinating blend of passion and smart financial thinking.

Unlike a stock certificate or a digital coin, a luxury watch is something real. You can hold it, wear it, and enjoy it, all while its value is potentially ticking upwards. This combination of hands-on utility and financial appreciation is precisely why so many savvy investors are taking a closer look at horology.

At its core, watch investing rests on three solid pillars: an enduring brand legacy, deliberate scarcity, and truly exceptional craftsmanship. Powerhouse brands like Rolex and Patek Philippe have spent over a century meticulously building their reputations. That history creates an unshakeable confidence in their quality and desirability, ensuring their watches aren't just passing fads but genuine, long-term stores of value.

Let's quickly break down these core pillars.

Key Investment Pillars for Luxury Timepieces

| Investment Pillar | Description | Example |

|---|---|---|

| Enduring Brand Legacy | Brands with a long, storied history of quality and innovation command trust and prestige, ensuring sustained demand across generations. | A Patek Philippe Calatrava, backed by nearly 200 years of horological excellence, is universally recognized as a blue-chip asset. |

| Intentional Scarcity | Manufacturers deliberately limit the production of certain models, creating a market where demand consistently outstrips supply. | Rolex's professional models, like the Daytona or Submariner, have notorious waitlists, driving their pre-owned market value well above retail. |

| Exceptional Craftsmanship | The immense skill and hundreds of hours of manual labor invested in each watch make it a functional piece of art, not a mass-produced item. | The intricate hand-finishing on an A. Lange & Söhne movement is a testament to artistry that simply cannot be replicated by machine. |

These pillars work together to create a stable and appreciating asset class, making luxury timepieces a compelling addition to a diversified portfolio.

The Power of Scarcity and Craftsmanship

Scarcity is a massive driver of value in this world. Watchmakers will often cap production for specific models, which creates an exclusive market where more people want the watch than can actually get one. This isn't just a clever marketing ploy; it's a direct result of the painstaking effort that goes into every single piece.

A high-end mechanical watch can easily take hundreds of hours to be assembled by a master watchmaker's hands, making it impossible to scale up production. This absolute dedication to mechanical perfection is why collectors and investors alike see these timepieces as functional art. You can see this dynamic in action by looking at some rare luxury watches that set auction records.

This has fueled a market that's not just robust, but growing. The global luxury watch market is expected to be worth around US$45 billion in 2025 and is projected to climb to US$61.2 billion by 2032, growing at a steady 4.5% each year. This isn't a bubble; it's driven by rising global wealth and a deep appreciation for mechanical masterpieces, particularly in strong markets like North America. You can dive into the numbers in the full luxury watch market research.

For an investor, a luxury watch serves a dual purpose. It acts as a potential hedge against inflation, holding its value during economic uncertainty, while also providing the unique emotional return of owning something truly exceptional.

Ultimately, putting your money into luxury watches lets you diversify into a stable, tangible asset with a proven history of appreciation. It's a strategic play that brings together the thrill of collecting with sound financial planning, making it an incredibly compelling option for any modern portfolio.

How to Spot an Investment-Grade Watch

Let's be clear: not every expensive watch is a good investment. While many are stunning pieces of engineering, only a select few have the right combination of factors to actually grow in value over time. It’s a lot like picking a stock—you have to look past the shiny exterior and dig into the fundamentals.

Getting this right means knowing what to look for. It really boils down to five key areas: the brand's reputation, the specific model, its rarity, the physical condition, and its history. Each one tells a part of the story and contributes to its future value.

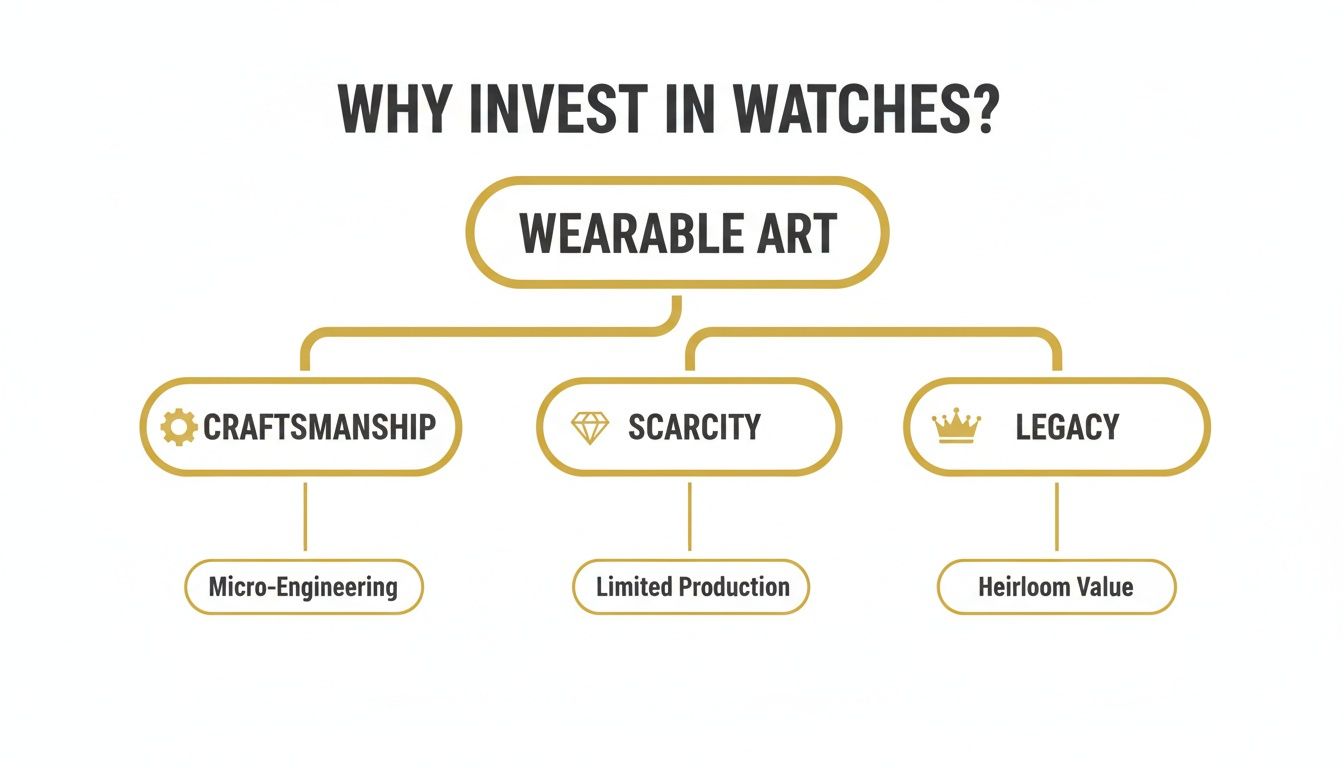

This flowchart sums up why these timepieces are so compelling as an asset class—they're a unique mix of artistry, scarcity, and history you can wear on your wrist.

As you can see, the idea of "Wearable Art" isn't just a marketing term. It's built on a solid foundation of incredible craftsmanship, deliberate scarcity, and the powerful legacy of iconic brands. Now, let's break down exactly what you need to analyze.

Brand Heritage and Market Authority

In the watch world, a brand's name is everything. Powerhouses like Rolex, Patek Philippe, and Audemars Piguet have spent over a century earning their reputations for quality, innovation, and prestige. That long history creates a powerful sense of trust and ensures there’s always a line of collectors waiting to buy.

This isn't just hype; the numbers back it up. A Rolex is universally recognized for its rock-solid construction and ability to hold value. In fact, between 2020 and 2024, Rolex absolutely dominated the secondary market, accounting for a massive 34.2% of global trade volume.

Buying from a blue-chip brand is like betting on a century of proven excellence. Their market authority acts as a buffer against passing trends, giving their watches a solid foundation for long-term growth.

The Significance of a Model and Reference Number

Even within a legendary brand, not all watches are on the same level. The specific model and its reference number are what truly matter. For instance, a Rolex Submariner is a rugged tool watch built for adventure, while a Rolex Cellini is a refined dress watch. They appeal to completely different buyers and perform differently on the market.

Some models become so iconic they become cultural touchstones. The Patek Philippe Nautilus, Audemars Piguet Royal Oak, and Rolex Daytona are perfect examples. Their unique designs and rich histories make them "grail" pieces for collectors, which keeps demand white-hot. For a deeper dive, check out our guide on the top Rolex models that retain and increase their value.

Rarity and Production Numbers

It's simple economics: scarcity drives value. When something is hard to get, people want it more. In watches, this rarity comes in a few key forms:

- Limited Editions: Pieces produced in a small, fixed run for a special occasion or partnership. They are rare from day one.

- Discontinued Models: When a brand stops making a popular reference, the supply is instantly capped. This often sends prices soaring as collectors scramble for the last available pieces.

- Low Production Volume: High-end independent watchmakers like F.P. Journe produce incredibly few watches each year because of their complexity. This makes virtually every watch they create a rare find.

A watch that’s tough to acquire will almost always fetch a premium. The classic tug-of-war between high demand and low supply is what makes the watch market tick.

Condition and Originality

The physical state of a watch is non-negotiable. For serious collectors, originality is king. An "unpolished" case that still has its original factory finishing—sharp lines, crisp edges—is far more desirable than one that's been polished smooth over the years. Polishing literally removes metal, forever changing the watch's original shape.

Here’s what to look for when assessing a watch's condition:

- The Case: Are there deep scratches or dings? Does it look like it’s been over-polished? You’re looking for a watch that’s as close to its factory state as possible.

- The Dial: The dial is the face of the watch, and it needs to be original. An untouched dial, even one with a bit of natural aging (patina), is always preferred over a refinished or restored one.

- The Movement: The engine has to run smoothly. A clean, well-maintained movement that keeps good time is a must. A record of a recent service from a certified watchmaker is a huge bonus.

Provenance: The Power of "Box and Papers"

Finally, there’s provenance—the watch’s documented history. Having a "full set" is the gold standard. This means you get the original box, warranty papers, instruction booklets, and even the original hang tags.

Think of the box and papers as a watch's birth certificate and passport. They confirm its authenticity and origin, adding a massive layer of trust and value. A watch without its papers can be worth 20-30% less than the exact same model with them. For any serious investor, provenance isn't just a nice-to-have; it's a must-have.

Choosing Your Path: New Versus Pre-Owned Watches

One of the first big questions you'll face as a watch investor is where to buy. Do you go for a box-fresh timepiece straight from an authorized dealer, or do you dive into the vibrant world of the pre-owned market? There’s no single right answer here—the best path for you hinges entirely on your investment strategy and what you hope to achieve.

Buying a brand new watch from an authorized dealer (AD) is an experience in itself. You're the very first person to own it, to peel off the protective plastics. It comes with the full manufacturer’s warranty and an undeniable guarantee of authenticity. For many, that direct link to the brand is a huge part of the appeal.

The catch? For the most coveted models from titans like Rolex or Patek Philippe, you’re not just buying a watch; you’re getting on a list. And those waitlists can be notoriously long and uncertain, sometimes stretching out for years. This scarcity signals incredible demand, but it also means your capital is tied up while you wait. Plus, not every new watch is an instant hit; some models can depreciate right after purchase, much like a new car driving off the lot, before their value finds its footing.

The Power of the Certified Pre-Owned Market

The certified pre-owned (CPO) market, on the other hand, plays by a completely different set of rules. Its single biggest advantage? Immediate access. You can pinpoint the exact watch you want and acquire it today, no waiting required. This agility lets you act on market trends and opportunities as they arise, instead of watching from the sidelines.

This is also the only place you'll find discontinued models or the increasingly popular "neo-vintage" pieces from the 90s and 2000s that have collectors buzzing. These watches have typically weathered any initial depreciation and are often on an upward trajectory, making them a fantastic entry point for savvy investors. If you want to dig deeper, check out our guide on buying used luxury watches.

The pre-owned market isn't just about second-hand goods; it's a strategic arena for acquiring proven assets. It allows investors to bypass waitlists, access rare and discontinued models, and potentially buy into a watch's appreciation curve at a more opportune moment.

Value and Appreciation: A Head-to-Head Look

At the end of the day, investing is about seeing your asset grow in value. This is where the pre-owned market truly flexes its muscle. You’re not locked into a fixed retail price; you’re buying at the current market value, which can create a much stronger foundation for future growth.

Pre-owned luxury watches have become a serious asset class. The secondary market is projected to grow at a 4-6% CAGR through 2032, with powerhouse brands like Rolex showing incredible value retention. Even with slight market shifts, Rolex's investment-grade status held firm in H1 2025. Icons like the Submariner often see average annual appreciation of 5-10%, easily outpacing inflation. You can explore more data in the secondary watch market report for H1 2025.

This stability makes the CPO market a fantastic place to build a collection, but it does demand more from the buyer. Due diligence is key. Authentication, condition checks, and confirming a watch's history are non-negotiable steps. That's why partnering with a trusted dealer like Perpetual Time is so important—we handle the expert verification, so you can invest with complete confidence.

Investment Comparison: New vs. Certified Pre-Owned

To make the decision clearer, here’s a side-by-side look at how the two paths stack up for an investor.

| Factor | New from Authorized Dealer | Certified Pre-Owned |

|---|---|---|

| Availability | Often involves long, uncertain waitlists for popular models. | Immediate access to a vast inventory, including rare pieces. |

| Initial Cost | Fixed Manufacturer's Suggested Retail Price (MSRP). | Market-driven pricing, offering potential value opportunities. |

| Depreciation Risk | Higher risk of initial depreciation for less sought-after models. | Initial depreciation has often already occurred. |

| Model Selection | Limited to current production models only. | Access to current, discontinued, and vintage/neo-vintage models. |

| Appreciation | Potential for significant appreciation if you can get a "hot" model. | Potential to buy into an established appreciation curve. |

| Due Diligence | Minimal; authenticity and condition are guaranteed. | Crucial; requires expert authentication and condition assessment. |

Ultimately, whether you choose new or CPO depends on your priorities. Are you after the "first owner" experience and have the patience to wait for it? Or is your focus on immediate access, uncovering value, and tapping into the unique opportunities that only the pre-owned market can offer? Answering that question is the first real step in building your watch investment portfolio.

A Practical Checklist for Buying and Selling

Picking the right watch is only half the battle. The real art of watch investing lies in how you handle the transaction itself, whether you're buying or selling.

Think of what follows as your field guide. It's a disciplined, step-by-step approach to navigating deals with confidence, protecting your investment, and making sure you come out on top. In this game, the details are everything. One missed step can turn a prized asset into a very expensive lesson.

The Essential Buyer Checklist

When you’re the one putting up the cash, the responsibility to get it right is all on you. A methodical, almost skeptical, mindset is your best friend. This checklist will keep you focused on what really matters before you commit.

-

Vet the Seller’s Reputation: This is your first and most important step. Look for established dealers like Perpetual Time who have a long, verifiable track record of happy clients. Do they have a physical storefront? What are their reviews like? If you’re on a forum, dig into the seller’s post history and feedback. A solid seller is your first line of defense against getting burned.

-

Scrutinize High-Res Photos & Videos: Never, ever buy a watch from stock photos. Insist on seeing clear, current pictures of the actual watch you're buying, from every possible angle. Look closely at the sharpness of the case lugs, check the bracelet for any stretch between the links, and inspect the dial for blemishes. A short video is even better—it shows how the light catches the surfaces, revealing hairline scratches a photo might hide.

-

Confirm the "Full Set" Details: If a watch is advertised as a "full set" with its original box and papers, you need proof. Ask for a crisp photo of the warranty card or certificate, making sure you can read the serial number and the original date of sale. Then, make sure that serial number perfectly matches the one on the watch itself. A complete set is a huge value-add for any investment piece.

-

Ask About Service History: "When was it last serviced, and who did the work?" A recent overhaul by a certified watchmaker is a massive bonus, potentially saving you a thousand dollars or more right off the bat. If an older watch has no service history, that's a cost you'll need to factor into your offer.

-

Ask Direct Questions About Originality: Don't be shy. Get specific. "Has the case been polished?" "Are the dial and hands original?" "Have any parts been swapped for aftermarket ones?" An honest seller will give you straight answers. If they get vague, that's a major red flag.

The Strategic Seller Checklist

When you're ready to sell, the goal is simple: get the best possible price while making the process seamless for the buyer. Proper prep work is what separates a great sale from a mediocre one. Our detailed guide on how to sell your Rolex watch gets into the weeds, but this checklist will get you started.

For sellers, preparation is everything. Presenting a watch professionally, with complete documentation and a clear history, removes buyer friction and builds the trust needed to command a premium price.

Getting this part right means you’re not leaving money on the table.

Preparing Your Watch for the Market

A little bit of effort here will pay dividends.

- Gather All Your Paperwork: Find that original box, the warranty card, the instruction booklets, hang tags, and any receipts from past services. Having a complete set can easily increase a watch's value by 20% or more. It’s the single most effective thing you can do.

- Get a Professional Appraisal: For a particularly valuable or vintage watch, a formal appraisal from a trusted expert gives you a validated market value. It gives you a firm footing for pricing and adds a layer of credibility that buyers appreciate.

- Take Professional-Grade Photos: You judged sellers on their photos, so now it's your turn. Clean your watch and take well-lit, high-quality pictures that honestly show its condition. Show off its best angles but also be transparent about any minor flaws.

- Choose the Right Sales Channel: Figure out how you want to sell. You could go for a direct sale to a trusted dealer like Perpetual Time, which is fast and secure. Or, you could use a consignment service or sell it yourself on a marketplace. Each route has its pros and cons in terms of speed, security, and the final price you’ll get. For most people, selling to a reputable dealer is the safest and most straightforward path.

Protecting and Preserving Your Watch Collection

You’ve found the right watch. The hunt is over. But if you’re a serious investor, your work has just begun. Buying the piece is only half the battle; the real long-term value comes from a disciplined approach to care and protection. Don't think of your watches as static objects in a box. They are high-performance machines that need regular attention to keep them in peak condition.

You wouldn't park a vintage Ferrari in the street, exposed to the elements, would you? The same principle applies here. A fine mechanical watch is vulnerable to dust, moisture, and accidental drops. Proper storage is your first line of defense, and for a growing collection, that means graduating from the sock drawer.

Smart Storage and Maintenance

The right storage solution does more than just keep your watches organized. It actively shields them from the slow, creeping damage that environmental factors can cause to their delicate inner workings.

-

Watch Winders: If you own automatic watches, a quality winder is a must-have. By gently rotating the watch, it keeps the mainspring wound and ensures the movement’s lubricants stay evenly distributed. This is critical—when a watch sits still for too long, those oils can congeal and gum up the works.

-

High-Quality Safes: As your collection grows in value, so does the risk. A proper home safe rated for jewelry, offering both fire and theft protection, isn't just a good idea; it’s essential for peace of mind. Make sure it has a soft, non-abrasive interior to keep your watches pristine.

Beyond just storing them safely, you have to actively maintain them. A mechanical watch is a symphony of hundreds of tiny, interacting parts. Over time, lubricants dry up and components wear down, throwing off its accuracy and leading to potentially catastrophic damage if left unchecked.

A consistent service history isn't just another expense. It's an investment in the watch's future value and a clear signal to the next buyer that this piece has been meticulously cared for.

Most watchmakers recommend a full service every 5 to 7 years. This isn't something to put off. Proactive care is what preserves both the mechanical soul and the financial value of your watch. You can see what goes into a professional tune-up by exploring our watch servicing process here at Perpetual Time.

Insuring Your Valuable Assets

This is the part many collectors get wrong. It's a common mistake to assume your standard homeowner's or renter's policy has you covered. The hard truth is that most of these policies have shockingly low limits for valuables like watches, often capping out at just $1,500 to $2,500.

A single high-value timepiece, let alone a whole collection, will blow past that limit in a heartbeat. That leaves you dangerously exposed if something gets stolen, lost, or damaged. You need specialized coverage.

You generally have two solid options:

- Scheduled Personal Property: Think of this as an add-on, or "rider," to your existing home insurance. You list each watch individually along with its appraised value. This route gives you much higher coverage limits and often protects against a wider range of risks, including accidental loss (like dropping it).

- Standalone Collection Insurance: For the serious collector, this is the gold standard. A dedicated policy from a company that specializes in valuables offers the most comprehensive protection. These policies are built for assets like watches and often include perks like coverage during shipping and automatic adjustments for market value appreciation.

Planning Your Exit Strategy

Every smart investment needs an exit plan. The goal is to sell when the time is right to maximize your return. This means you need to have your finger on the pulse of the market, watching for trends related to your specific models.

Trying to time the market perfectly is a fool's errand, but you can definitely stack the odds in your favor. Keep a close eye on auction results for comparable watches, track secondary market prices on trusted platforms, and stay plugged into brand news. A model discontinuation, for instance, can cause demand—and prices—to skyrocket overnight.

When you do decide to sell, working with a reputable dealer is the surest way to get a secure, transparent transaction that reflects the true market value of the investment you’ve so carefully protected.

Common Mistakes to Avoid in Watch Investing

It’s one thing to know which watch to buy, but it's just as important to know which mistakes to sidestep. The road to a great collection is littered with traps that can turn a prized asset into an expensive lesson. The investors who succeed aren’t just the most passionate; they’re the most disciplined.

One of the biggest blunders is letting your heart run the show. It's incredibly easy to fall for a watch's story or aesthetic, but cold, hard data is what protects your capital. A classic mistake is jumping on a watch at the absolute peak of its hype cycle, often fueled by a sudden surge on social media. That's not investing; it's chasing, and it rarely ends well.

Another trap that catches many newcomers is failing to see beyond the initial price tag. The number on the invoice is just your entry fee.

Ignoring Hidden Ownership Costs

The total cost of ownership is a real factor that many people only discover after the fact. These aren't just "nice-to-haves"—they are essential expenses for protecting your watch's value and ensuring it runs properly for years to come.

- Servicing Costs: Think of it like a high-performance car. You wouldn't skip an oil change, would you? A full mechanical service from a certified watchmaker will run you $800 to $2,000+ every five to seven years. Neglecting this is asking for a catastrophic—and far more expensive—mechanical failure down the line.

- Insurance Premiums: As we've touched on, your standard homeowner's policy won't cut it. A specialized collector's insurance policy is a recurring cost you absolutely must build into your budget. It’s the only way to be truly protected from theft, damage, or loss.

Forgetting to budget for these expenses can completely wipe out any gains you might make when it's time to sell.

Underestimating Authenticity and Condition

In the pre-owned market, authenticity isn't just important—it's everything. A particularly nasty surprise for the unwary is the "Frankenwatch," a timepiece assembled from a mix of genuine and aftermarket parts. To the untrained eye, it might look right, but its actual market value is a tiny fraction of a watch that is 100% original.

Likewise, don't ever underestimate the power of a "full set." A watch that’s missing its original box and papers can sell for 20-30% less than the exact same model that has them. Think of that paperwork as the watch's birth certificate and passport; it proves where it came from and gives the next buyer immense confidence.

The best watch investors I know are patient, diligent, and just a little bit skeptical. They approach every potential purchase as a serious transaction, verifying the details and trusting verifiable facts over flashy trends.

By steering clear of emotional buys, planning for the true cost of ownership, and insisting on iron-clad proof of authenticity and provenance, you’re laying the groundwork for a collection that’s not only a source of pride but a serious financial asset.

Your Watch Investment Questions Answered

Even after covering the basics, you're bound to have some specific questions rattling around. It's only natural. This final section tackles some of the most common things we hear from collectors, whether they're just starting out or have been in the game for years. Let's get you some clear, direct answers.

How Much Money Do I Need to Start?

There’s no magic number here. Your starting point really depends on what you want to achieve. Sure, the watches grabbing headlines at auction fetch millions, but you can break into the investment-grade market for a lot less than you might think.

You can find some really solid entry points in the $5,000 to $10,000 range. This is especially true in the certified pre-owned market, where you can find iconic models from powerhouse brands like Rolex, Omega, or Tudor. The real key isn't just the price tag; it's about buying the absolute best quality you can afford. Always prioritize a watch's condition and history over just snagging a bigger name. A pristine example of a less-hyped model is almost always a smarter long-term play than a beat-up version of a more famous one.

Are There Tax Implications When I Sell a Watch?

Absolutely, and this is something you can't afford to overlook. When you sell a watch for more than you paid, that profit is considered a capital gain by tax authorities like the IRS. In their eyes, luxury watches are "collectibles," and these are often taxed at a higher rate than your gains from stocks or bonds.

Just how much higher? The specific tax rate on collectibles can climb as high as 28%, depending on your income and how long you owned the watch. It’s always a good idea to chat with a tax professional before you sell to figure out exactly what you'll owe.

How Long Should I Hold a Watch Before Selling?

Patience is the name of the game here. While certain "hype" models can shoot up in value overnight, a truly sustainable investment strategy means holding onto a quality timepiece for at least five to ten years.

This longer timeframe gives your watch a chance to ride out the market's inevitable ups and downs. It allows the value to grow organically, driven by the steady forces of brand prestige and increasing scarcity. Think of it less like day trading and more like aging a fine wine. The longer you wait, the more its story, rarity, and desirability build, cementing its place as a valuable asset.

At Perpetual Time, we believe an educated investor is a confident one. Our team is here to give you the transparency and rigorous authentication you need to build your collection with total peace of mind. To start your journey on the right foot, explore our curated selection of certified pre-owned timepieces by visiting us at https://perpetualtime.com.